A PENSIONER from Stockbridge has expressed concern over the growing lack of access to cash in the area.

John Parrott has voiced his frustration over the lack of places there are in the community to withdraw cash, with the only two options being Sainsbury’s and Tesco in Andover, as well as the Co-op in Stockbridge.

Mr Parrott, 80, doesn’t like to keep too much cash in the house due to theft worries.

He said: “It’s a future worry because I rely on cash point machines to get cash. I’m not in the best of health, which makes things difficult and I’m concerned I’m not going to be driving for much longer because of my age.”

The closest bank to Mr Parrott is in Andover town centre, which he finds a struggle to get to because of his age.

READ MORE: Hampshire woman cautioned for stealing fast food deliveries three times

He said: “It means I have to drive and find a close enough parking space in Andover just to get cash.

“The banks now shut at 5pm and they’re not open at all on a Sunday and close at midday on Saturday.

“There are also no buses, which makes it hard. In the village it’s very limited hours.”

Mr Parrott lives alone and finds it difficult getting things done by himself.

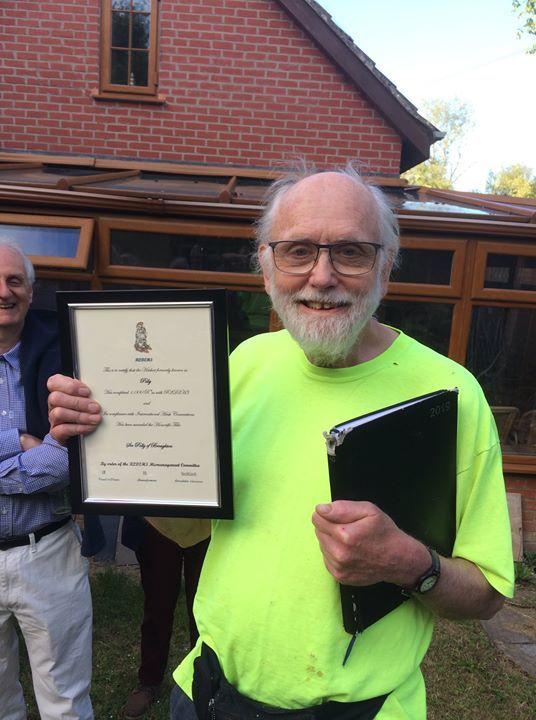

His friend, Melvin Vayle, has been acknowledged for the support he has given - and he agreed that accessing cash in the community is a growing concern for many particularly elderly people. He said: “Melvin’s help means a lot to me.”

Melvin, 52, from Broughton, said: “He’s a good friend. He’s a friend in need and I want to help as much as I can.”

John and Melvin’s frustration at the growing lack of access to cash has been shared with countless other people in the Hampshire area on the back of a campaign by consumer publication Which?.

SEE ALSO: The Mark Way School to get £2.2m investment

The publication is calling for legislation to protect cash to be introduced.

Jenny Ross, Which? money editor, said: “Having the ability to access and use cash is a lifeline for some of the most vulnerable people in society, and they must not be left behind as many others move to digital payments.

“The impact of losing access to cash can be devastating in a community, so it’s vital that people’s voices are heard and the government takes action to protect our fragile cash system.

“Voluntary initiatives from the banks simply won’t be enough to properly protect cash. The government must urgently press ahead with its long-promised legislation to ensure consumers can continue to access cash for as long as it is needed.”

Message from the editor

Thank you for reading this story. We really appreciate your support.

Please help us to continue bringing you all the trusted news from your area by sharing this story or by following our Facebook page.

Kimberley Barber

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here